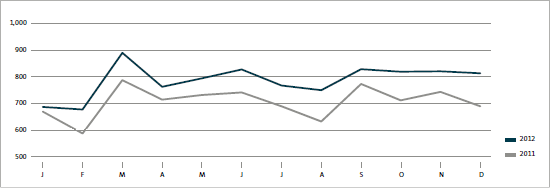

The Volkswagen Group delivered more than 9,275,909 vehicles to customers worldwide in 2012. This corresponds to an increase of 1,010,643 or 12.2% compared with the previous year. The first chart on this page shows that the delivery figures were higher in all twelve months of the reporting period than in the same months of the previous year. Details for deliveries of passenger cars and light commercial vehicles, and of trucks and buses, are provided separately in the following.

|

VOLKSWAGEN GROUP DELIVERIES* |

|

| ||||||

|

|

2012 |

2011 |

% | |||||

|---|---|---|---|---|---|---|---|---|

| ||||||||

|

Passenger cars and light commercial vehicles |

9,074,283 |

8,160,408 |

+11.2 | |||||

|

Trucks and buses |

201,626 |

104,858 |

+92.3 | |||||

|

Total |

9,275,909 |

8,265,266 |

+12.2 | |||||

VOLKSWAGEN GROUP DELIVERIES BY MONTH

Vehicles in thousands

PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE DELIVERIES

With its brands, the Volkswagen Group has a presence in all relevant automotive markets around the world. Western Europe, China, Brazil, the USA, Russia, Argentina and Mexico are currently the key sales markets for the Group. The Group continued to extend its strong competitive position in the reporting period thanks to its wide range of attractive and environmentally friendly models. We have increased our market share in key core markets and again recorded an encouraging global increase in demand.

The Volkswagen Group delivered 9,074,283 passenger cars and light commercial vehicles to customers in 2012. Since August 1, 2012, these figures also include Porsche brand vehicles. The previous year’s record figure was exceeded by 11.2%. With the exception of the SEAT brand, which was hit particularly hard by the difficult market conditions in Western Europe, and Bugatti, all Group brands surpassed their 2011 sales figures. Volkswagen Passenger Cars, Audi, ŠKODA and Volkswagen Commercial Vehicles all recorded their best ever delivery figures. Bentley and Lamborghini also registered strong growth rates. Demand for Volkswagen Group models was higher than in the prior-year period in virtually all markets outside Western Europe. The table below gives an overview of deliveries to customers in the different markets and of the respective passenger car market shares held by the Volkswagen Group. We describe the demand trends for Group models in the individual markets in the following sections.

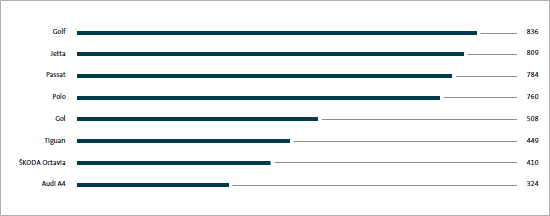

WORLDWIDE DELIVERIES OF THE GROUP’S MOST SUCCESSFUL MODELS IN 2012

Vehicles in thousands

Deliveries in Europe/Remaining markets

The overall market slowdown in Western Europe in 2012 resulted in our deliveries to customers in this region declining year-on-year. Our sales figures were down on the previous year in all major markets here, apart from Germany and the United Kingdom. Vehicles sold in Western Europe accounted for 33.3% (previous year: 38.4%) of the Group’s total delivery volumes. Except for SEAT, all volume brands sold more vehicles in the reporting period than in the previous year. The Tiguan, Audi A6, ŠKODA Roomster, ŠKODA Yeti, SEAT Alhambra, Amarok and Crafter models all registered positive growth rates. The new up!, Beetle, Golf Cabriolet, Audi Q3, ŠKODA Citigo and SEAT Mii models were also very popular. The Volkswagen Group’s share of the overall passenger car market in Western Europe rose to 24.4% (23.0%).

The Volkswagen Group’s sales figures in Central and Eastern Europe surpassed the prior-year level by 17.6%. We recorded the highest growth rates in Russia (+38.8%) and the Ukraine (+29.6%). The Polo Sedan, Tiguan, Passat, CC, Touareg, the Audi A3, A6 and Q7, the ŠKODA Octavia and all Volkswagen Commercial Vehicles models experienced higher demand in Central and Eastern Europe than in the previous year. The new Jetta, Audi Q3 and ŠKODA Citigo models were also very popular.

The Volkswagen Group’s deliveries in the South African market increased by 10.0%. Our entry-level models were particularly sought-after. The Group’s market share of 22.7% remained unchanged.

Demand for Group vehicles in the Middle East region grew by 17.6% compared with 2011.

Deliveries in Germany

Group deliveries to customers in the German market increased by 1.9% in fiscal year 2012 compared with the previous year. By contrast, the overall passenger car market volume declined by 2.9%. The Tiguan, CC, Touareg, Audi A1, Audi A6, ŠKODA Roomster, ŠKODA Yeti, SEAT Ibiza, SEAT Leon and Crafter models experienced the highest growth rates. The new up!, Beetle, Golf Cabriolet, Audi Q3, ŠKODA Citigo and SEAT Mii models were also very popular. At the end of the reporting period, eight Volkswagen Group models led the Kraftfahrtbundesamt (KBA – German Federal Motor Transport Authority) registration statistics in their respective segments: the up!, Polo, Golf, Passat, Touran, Tiguan, Audi A6/A7 and Caddy. The Golf continued to top the list of the most frequently registered passenger cars in Germany. We lifted the Volkswagen Group’s market share in the German passenger car market to 37.7% in the reporting period (previous year: 35.9%), further cementing our market leadership.

Deliveries in North America

Demand for Group vehicles in the US market grew by 34.2% year-on-year, outperforming the positive trend in the overall market (+13.4%). The Golf, Tiguan, Passat, Audi Q5, Audi A6 and Audi Q7 models recorded the highest growth rates. In Canada we recorded year-on-year growth of 15.7%. Demand for the Passat, Touareg, Audi A4, Audi Q5 and Audi A7 models was encouraging there. The Group’s sales figures in Mexico surpassed the prior-year level by 7.8%. Demand increased for the Voyage, Beetle, Passat, Audi A1 and SEAT Ibiza models.

Deliveries in South America

The Volkswagen Group’s deliveries in the South America region rose 8.2% in the reporting period. After declining slightly in 2011, our sales figures in Brazil were again positive in 2012 (+10.7%). This was attributable to a temporary tax cut for new vehicles as well as the market launch of the new generations of the Gol and the Voyage. The Fox was also highly popular and sales of the Amarok almost doubled.

Demand for Volkswagen Group vehicles declined by 5.1% in Argentina. However, the Fox, Audi A3 and Saveiro models recorded stronger demand than in 2011. With a market share of 25.0% (previous year: 25.1%), the Volkswagen Group maintained its market leadership.

Deliveries in the Asia-Pacific region

The Volkswagen Group increased sales in the Asia-Pacific region by 23.3% compared with the prior-year figure, outperforming the passenger car market as a whole (+13.3%). Growth in the region was again driven by the Chinese market, which saw demand for Group vehicles rise by 24.5%. Virtually all models contributed to this positive result. We extended our leadership of the Chinese market with a market share of 20.8% (previous year: 18.2%).

Deliveries to customers in the Indian market increased by 2.1%. The Passat, Audi A4, Audi A6 and ŠKODA Rapid models recorded the highest growth rates.

In Japan, our sales figures were up 14.4% year-on-year. The Beetle, Passat and Audi A6 models were particularly popular.

Deliveries to customers continued to develop positively in the other markets in the Asia-Pacific region.

|

PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE DELIVERIES TO CUSTOMERS BY MARKET1 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

Deliveries (units ) |

Change |

Share of passenger car market (%) | |||||||||||

|

|

2012 |

2011 |

(%) |

2012 |

2011 | |||||||||

| ||||||||||||||

|

Europe/Remaining markets |

4,053,038 |

3,990,679 |

+1.6 |

|

| |||||||||

|

Western Europe |

3,023,366 |

3,130,072 |

–3.4 |

24.4 |

23.0 | |||||||||

|

of which: Germany |

1,175,514 |

1,153,070 |

+1.9 |

37.7 |

35.9 | |||||||||

|

United Kingdom |

434,798 |

408,869 |

+6.3 |

19.8 |

19.3 | |||||||||

|

France |

279,127 |

299,330 |

–6.7 |

14.2 |

12.8 | |||||||||

|

Italy |

196,964 |

244,953 |

–19.6 |

13.2 |

13.1 | |||||||||

|

Spain |

175,810 |

212,549 |

–17.3 |

24.0 |

24.7 | |||||||||

|

Central and Eastern Europe |

644,347 |

547,779 |

+17.6 |

15.4 |

13.9 | |||||||||

|

of which: Russia |

317,735 |

228,977 |

+38.8 |

11.1 |

8.9 | |||||||||

|

Czech Republic |

85,347 |

82,874 |

+3.0 |

46.3 |

45.4 | |||||||||

|

Poland |

74,569 |

73,391 |

+1.6 |

25.4 |

24.8 | |||||||||

|

Remaining markets |

385,325 |

312,828 |

+23.2 |

|

| |||||||||

|

of which: Turkey |

123,811 |

107,913 |

+14.7 |

17.6 |

13.7 | |||||||||

|

South Africa |

109,396 |

99,427 |

+10.0 |

22.7 |

22.7 | |||||||||

|

North America2 |

841,540 |

666,827 |

+26.2 |

4.9 |

4.3 | |||||||||

|

of which: USA |

596,078 |

444,187 |

+34.2 |

4.1 |

3.5 | |||||||||

|

Mexico |

164,890 |

153,023 |

+7.8 |

16.7 |

16.9 | |||||||||

|

Canada |

80,572 |

69,617 |

+15.7 |

4.8 |

4.4 | |||||||||

|

South America |

1,010,112 |

933,133 |

+8.2 |

19.6 |

18.9 | |||||||||

|

of which: Brazil |

780,195 |

704,726 |

+10.7 |

23.0 |

22.3 | |||||||||

|

Argentina |

169,043 |

178,170 |

–5.1 |

25.0 |

25.1 | |||||||||

|

Asia-Pacific |

3,169,593 |

2,569,769 |

+23.3 |

12.2 |

11.3 | |||||||||

|

of which: China |

2,812,051 |

2,258,614 |

+24.5 |

20.8 |

18.2 | |||||||||

|

India |

114,084 |

111,689 |

+2.1 |

4.5 |

4.9 | |||||||||

|

Japan |

82,078 |

71,729 |

+14.4 |

1.8 |

2.0 | |||||||||

|

Worldwide |

9,074,283 |

8,160,408 |

+11.2 |

12.8 |

12.3 | |||||||||

|

Volkswagen Passenger Cars |

5,738,449 |

5,091,035 |

+12.7 |

|

| |||||||||

|

Audi |

1,455,123 |

1,302,659 |

+11.7 |

|

| |||||||||

|

ŠKODA |

939,202 |

879,184 |

+6.8 |

|

| |||||||||

|

SEAT |

321,002 |

350,009 |

–8.3 |

|

| |||||||||

|

Bentley |

8,510 |

7,003 |

+21.5 |

|

| |||||||||

|

Lamborghini |

2,083 |

1,602 |

+30.0 |

|

| |||||||||

|

Porsche |

59,513 |

– |

– |

|

| |||||||||

|

Volkswagen Commercial Vehicles |

550,370 |

528,878 |

+4.1 |

|

| |||||||||

|

Bugatti |

31 |

38 |

–18.4 |

|

| |||||||||

DELIVERIES OF TRUCKS AND BUSES

In fiscal year 2012, the Volkswagen Group delivered 201,626 trucks and buses to customers worldwide, with trucks accounting for 180,055 units. In any comparison with the previous year, it should be noted that the MAN brand’s sales figures are included as from November 9, 2011. The Scania brand registered a 15.9% decline in deliveries year-on-year to 67,401 units.

Demand for Volkswagen Group trucks and buses in Western Europe amounted to 68,557 units, of which 64,544 were trucks. The Western European market continues to be dominated by the ongoing sovereign debt crisis and the uncertainty associated with it.

In Central and Eastern Europe, we delivered 27,502 vehicles, of which 26,887 were trucks. In Russia, the positive trend in the relevant economic sectors, such as the construction industry and the consumer goods market, continued to have a positive impact on market growth and thus on our Group brands. However, the market slowed down in the second half of the year after the introduction of a new recycling fee for all vehicles.

In the Remaining markets, we sold 21,052 vehicles, of which 18,626 units were trucks.

In the North American markets we delivered 410 trucks and 1,381 buses in the reporting period.

In South America, the Volkswagen Group sold 71,750 vehicles, of which 60,294 were trucks. We delivered 51,137 trucks and 8,833 buses to customers in the Brazilian market. The implementation of the Euro 5 emission standard had a dampening effect.

Sales to customers in the markets of the Asia-Pacific region comprised 10,974 units, 9,294 of which were trucks. The Group delivered 2,983 trucks and 196 buses in the Chinese market.

|

TRUCK AND BUS DELIVERIES TO CUSTOMERS BY MARKET* | ||||||||

|---|---|---|---|---|---|---|---|---|

|

|

Deliveries (units ) |

Change | ||||||

|

|

2012 |

2011 |

(%) | |||||

| ||||||||

|

Europe/Remaining markets |

117,111 |

67,526 |

+73.4 | |||||

|

Western Europe |

68,557 |

38,073 |

+80.1 | |||||

|

Central and Eastern Europe |

27,502 |

15,194 |

+81.0 | |||||

|

Remaining markets |

21,052 |

14,259 |

+47.6 | |||||

|

North America |

1,791 |

813 |

x | |||||

|

South America |

71,750 |

29,709 |

x | |||||

|

of which: Brazil |

59,970 |

23,497 |

x | |||||

|

Asia-Pacific |

10,974 |

6,810 |

+61.1 | |||||

|

of which: China |

3,179 |

1,672 |

+90.1 | |||||

|

Worldwide |

201,626 |

104,858 |

+92.3 | |||||

|

Scania |

67,401 |

80,108 |

–15.9 | |||||

|

MAN |

134,225 |

24,750 |

x | |||||

DELIVERIES IN THE POWER ENGINEERING SEGMENT

Orders in the Power Engineering segment are usually part of major investment projects. Lead times typically range from just under one year to several years and partial deliveries as construction progresses are common. Accordingly, there is a time lag between incoming orders and sales revenue from the new construction business.

Sales revenue in the Power Engineering segment was largely driven by Engines & Marine Systems and Turbomachinery, which generated about three-quarters of the overall revenue volume.