Volkswagen Group continues successful course and again generates excellent results

The integrated automotive group was created in 2012 with the contribution in full of Dr. Ing. h.c. F. Porsche AG to the Volkswagen Group. Sales revenue and earnings exceeded the record 2011 levels.

The Volkswagen Group’s segment reporting in  compliance with IFRS 8 comprises the four reportable segments Passenger Cars and Light Commercial Vehicles, Trucks and Buses, Power Engineering, and Financial Services, in line with the Group’s internal reporting and management.

compliance with IFRS 8 comprises the four reportable segments Passenger Cars and Light Commercial Vehicles, Trucks and Buses, Power Engineering, and Financial Services, in line with the Group’s internal reporting and management.

At Volkswagen, segment profit or loss is measured on the basis of operating profit or loss.

The reconciliation contains activities and other operations that do not by definition constitute segments. These include the unallocated Group financing activities. Consolidation adjustments between the segments (including the holding company functions) are also contained in the reconciliation. Purchase price allocation for Porsche Holding Salzburg and Porsche, as well as for Scania and MAN, is in line with their accounting treatment in the segments.

The Automotive Division comprises the Passenger Cars and Light Commercial Vehicles, Trucks and Buses, and Power Engineering segments, as well as the figures from the reconciliation. The Passenger Cars and Light Commercial Vehicles segment and the reconciliation are combined to find the Passenger Cars and Light Commercial Vehicles Business Area. We report on the Trucks

and Buses and Power Engineering segments under the Trucks and Buses, Power Engineering Business Area. The Financial Services Division corresponds to the Financial Services segment.

The activities of the Passenger Cars and Light Commercial Vehicles segment cover the development of vehicles and engines, the production and sale of passenger cars and light commercial vehicles, and the genuine parts business. This segment is composed of the Volkswagen Group’s individual passenger car brands and light commercial vehicles on a consolidated basis. It also includes the Ducati brand’s motorcycle business.

The Trucks and Buses segment primarily comprises the development, production and sale of trucks and buses from the Scania and MAN brands, the corresponding genuine parts business and related services.

The Power Engineering segment combines the large-bore diesel engines, turbomachinery, special gear units, propulsion components and testing systems businesses.

The Financial Services segment comprises dealer and customer financing, leasing, banking and insurance activities, as well as fleet management.

CONSOLIDATION OF PORSCHE AG

The contribution in full of Porsche SE’s operative automotive business, which primarily consists of the 50.1% interest in Porsche Holding Stuttgart GmbH (and thus indirectly in Porsche AG), was completed on August 1, 2012 for share-based and cash consideration. Porsche AG has been consolidated in the Group since that date, which significantly influenced the results of operations, financial position and net assets of the Automotive Division in the reporting period.

Porsche Holding Stuttgart GmbH previously operated under the name Porsche Zweite Zwischenholding GmbH and is the legal successor to Porsche Zwischenholding GmbH. Porsche’s automotive business is allocated to the Passenger Cars and Light Commercial Vehicles Business Area within the Automotive Division and Porsche’s financial services business is allocated to the corresponding division.

The measurement of the put/call options relating to Porsche Holding Stuttgart GmbH was updated at the contribution date. In addition, the existing shares held were remeasured at the time of the transition in accounting for Porsche from the equity method to consolidation. Based on the updated underlying assumptions, this resulted in a significant noncash gain in the financial result.

The cash outflow from investing activities reported in the cash flow statement reflects the payment of the consideration less cash and cash equivalents acquired from Porsche. Net liquidity was also reduced by Porsche’s debt.

Total assets increased as a result of the addition of Porsche’s primary assets and liabilities and their remeasurement as part of purchase price allocation.

RESULTS OF OPERATIONS OF THE GROUP

The Volkswagen Group generated sales revenue of €192.7 billion in fiscal year 2012, surpassing the prior-year figure by 20.9%. The increase was primarily attributable to higher volumes and the consolidation of MAN SE (November 9, 2011) and Porsche AG (August 1, 2012). The largest proportion of sales revenue, at 80.4% (78.3%), was recorded outside of Germany. Gross profit rose by 25.7% to €35.2 billion. Positive exchange rate effects, increased volumes and improved product costs more than offset negative effects from the high write-downs relating to the purchase price allocation for MAN and Porsche in the period shortly following their acquisition. The gross margin improved from 17.6% to 18.2%. At €11.5 billion, operating profit exceeded the record prior-year figure (€11.3 billion). Distribution and administrative costs rose as a result of the initial consolidation of MAN and Porsche, write-downs relating to their purchase price allocation and business expansion, while other operating income decreased. The operating return on sales declined to 6.0% (7.1%).

|

KEY FIGURES BY SEGMENT |

|

| ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

€ million |

Passenger Cars and Light Commercial Vehicles |

Trucks and Buses |

Power Engineering |

Financial Services |

Total segments |

Recon-ciliation |

Volkswagen Group | |||||||

|

Sales revenue |

158,074 |

20,567 |

4,234 |

19,854 |

202,728 |

–10,052 |

192,676 | |||||||

|

Segment profit or loss |

10,778 |

358 |

161 |

1,586 |

12,883 |

–1,373 |

11,510 | |||||||

|

as % of sales revenue |

6.8 |

1.7 |

3.8 |

8.0 |

|

|

6.0 | |||||||

CONSOLIDATED PROFIT

At €25.5 billion, the Volkswagen Group’s profit before tax in the reporting period was significantly higher than in 2011 (€18.9 billion) due to positive measurement effects in the financial result. The return on sales before tax rose from 11.9% in the previous year to 13.2%. At €21.9 billion, the Volkswagen Group’s profit after tax exceeded the prior-year figure by €6.1 billion. The tax rate was 14.2%; effects from the updated measurement of options relating to Porsche Holding Stuttgart GmbH and the remeasurement of the existing shares held in the amount of €12.3 billion did not have any impact on the tax expense.

|

INCOME STATEMENT BY DIVISION |

|

| ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

Volkswagen Group |

Automotive* |

Financial Services | |||||||||||

|

€ million |

2012 |

2011 |

2012 |

2011 |

2012 |

2011 | ||||||||

| ||||||||||||||

|

Sales revenue |

192,676 |

159,337 |

172,822 |

142,092 |

19,854 |

17,244 | ||||||||

|

Cost of sales |

–157,518 |

–131,371 |

–142,154 |

–117,853 |

–15,364 |

–13,518 | ||||||||

|

Gross profit |

35,158 |

27,965 |

30,668 |

24,239 |

4,490 |

3,727 | ||||||||

|

Distribution expenses |

–18,850 |

–14,582 |

–17,932 |

–13,808 |

–918 |

–774 | ||||||||

|

Administrative expenses |

–6,223 |

–4,384 |

–5,159 |

–3,562 |

–1,065 |

–822 | ||||||||

|

Net other operating income |

1,426 |

2,271 |

2,347 |

3,104 |

–921 |

–832 | ||||||||

|

Operating profit |

11,510 |

11,271 |

9,923 |

9,973 |

1,586 |

1,298 | ||||||||

|

Share of profits and losses of equityaccounted investments |

13,568 |

2,174 |

13,423 |

2,041 |

145 |

133 | ||||||||

|

Other financial result |

414 |

5,481 |

554 |

5,510 |

–140 |

–30 | ||||||||

|

Financial result |

13,982 |

7,655 |

13,977 |

7,551 |

5 |

104 | ||||||||

|

Profit before tax |

25,492 |

18,926 |

23,900 |

17,524 |

1,591 |

1,402 | ||||||||

|

Income tax expense |

–3,608 |

–3,126 |

–3,219 |

–2,702 |

–388 |

–424 | ||||||||

|

Profit after tax |

21,884 |

15,799 |

20,681 |

14,822 |

1,203 |

978 | ||||||||

|

Noncontrolling interests |

168 |

391 |

145 |

370 |

23 |

20 | ||||||||

|

Profit attributable to shareholders of Volkswagen AG |

21,717 |

15,409 |

20,536 |

14,451 |

1,181 |

957 | ||||||||

RESULTS OF OPERATIONS IN THE AUTOMOTIVE DIVISION

The Automotive Division generated sales revenue of €172.8 billion in fiscal year 2012, up 21.6% on the prior-year figure. In addition to higher volumes, this was primarily buoyed up by favorable exchange rates. The increase in sales revenue was also significantly influenced by the consolidation of Porsche and MAN. As our Chinese joint ventures are accounted for using the equity method, the Group’s positive business growth in the Chinese passenger car market is mainly reflected in the Group’s sales revenue only by deliveries of vehicles and vehicle parts. The cost of sales rose more slowly than sales revenue (+20.6%). As a result, operating profit improved to €30.7 billion (€24.2 billion) in the reporting period. The gross margin increased to 17.7% (17.1%).

Distribution and administrative expenses rose by 29.9% and 44.8% respectively. The ratio of both distribution and administrative expenses to sales revenue was also higher than in 2011. The consolidation effects outlined above, increased business volumes and greater competition – particularly in Western Europe – had a significant effect on the prior-year comparison. Other operating income declined by €0.8 billion to €2.3 billion as a result of exchange rate factors.

The Automotive Division generated an operating profit of €9.9 billion (€10.0 billion) in 2012. The negative effects of purchase price allocation for MAN and Porsche, as well as from the switch to the  Modular Transverse Toolkit, were offset by higher volumes, optimized product costs and positive exchange rate effects in particular. The extremely strong business performance of our Chinese joint ventures is not reflected in the operating profit, as these are accounted for using the equity method. The ratio of operating profit to sales revenue was 5.7% (7.0%).

Modular Transverse Toolkit, were offset by higher volumes, optimized product costs and positive exchange rate effects in particular. The extremely strong business performance of our Chinese joint ventures is not reflected in the operating profit, as these are accounted for using the equity method. The ratio of operating profit to sales revenue was 5.7% (7.0%).

At €14.0 billion, the financial result for the Automotive Division was almost twice as high as in the previous year (€7.6 billion). This is primarily attributable to the updating of the underlying assumptions used in the valuation models for measuring the put/call rights relating to Porsche Holding Stuttgart GmbH in the amount of €1.9 billion (previous year €6.6 billion), as well as the remeasurement of existing shares held at the contribution date in the amount of €10.4 billion (€– billion). Improved income from the equity-accounted Chinese joint ventures included in the consolidated financial statements also had a positive effect. The measurement of derivative financial instruments and higher financing costs had a negative effect. These increased as a result of the refinancing of higher business volumes and the unwinding of discounts on provisions, which was made necessary by lower interest rates.

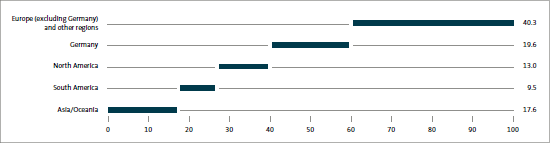

SEGMENT REPORTING – SHARE OF SALES REVENUE BY MARKET 2012

as percent

Results of operations in the Passenger Cars and Light Commercial Vehicles Business Area

The Passenger Cars and Light Commercial Vehicles Business Area generated sales revenue of €148.0 billion in the reporting period (€129.7 billion). The year-on-year increase was due to volume growth, positive exchange rate and model mix effects, as well as the consolidation of Porsche and Porsche Holding Salzburg (March 1, 2011). Gross profit amounted to €26.8 billion (€22.1 billion). Operating profit in the Passenger Cars and Light Commercial Vehicles Business Area rose by 4.0% to €9.4 billion (€9.0 billion). Porsche made a positive contribution to earnings despite the high initial write-downs from purchase price allocation.

|

RESULTS OF OPERATIONS IN THE PASSENGER CARS AND LIGHT COMMERCIAL VEHICLES BUSINESS AREA | ||||

|

€ million |

2012 |

2011 | ||

|---|---|---|---|---|

|

Sales revenue |

148,021 |

129,706 | ||

|

Gross profit |

26,811 |

22,108 | ||

|

Operating profit |

9,405 |

9,042 | ||

Results of operations in the Trucks and Buses, Power Engineering Business Area

At €24.8 billion (€12.4 billion), sales revenue in the Trucks and Buses, Power Engineering Business Area was significantly higher than in the previous year due to the consolidation of MAN on November 9, 2011. As a result, gross profit rose by €1.7 billion to €3.9 billion. Operating profit was down on the previous year at €0.5 billion (€0.9 billion). In addition to the write-downs relating to purchase price allocation for MAN and Scania, this was negatively impacted by a year-on-year contraction in the markets and increased competition.

|

RESULTS OF OPERATIONS IN THE TRUCKS AND BUSES, POWER ENGINEERING BUSINESS AREA | ||||

|

€ million |

2012 |

2011 | ||

|---|---|---|---|---|

|

Sales revenue |

24,801 |

12,386 | ||

|

Gross profit |

3,856 |

2,131 | ||

|

Operating profit |

519 |

931 | ||

RESULTS OF OPERATIONS IN THE FINANCIAL SERVICES DIVISI0N

The Financial Services Division lifted its sales revenue by 15.1% to €19.9 billion in fiscal year 2012. In addition to increased volumes, in particular the expansion of the consolidated Group including Porsche and MAN, had a positive effect compared with the previous year’s figures. Gross profit improved to €4.5 billion (€3.7 billion). Higher volumes and the consolidation effects outlined above, as well as upfront expenditures for new projects and additional expenses to comply with stricter banking supervision requirements saw both distribution and administrative expenses rise as against 2011. Other operating income amounted to €–0.9 billion (€–0.8 billion). The Financial Services Division once again made a significant contribution to the Group’s earnings with an operating profit of €1.6 billion (€1.3 billion). Return on equity before tax was lower than in the previous year at 13.1% (14.0%).