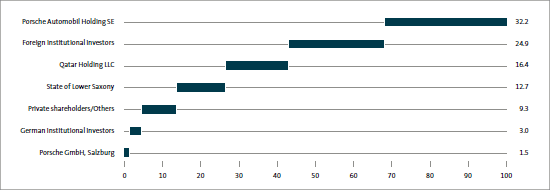

SHAREHOLDER STRUCTURE AT DECEMBER 31, 2012

as a percentage of subscribed capital

SHAREHOLDER STRUCTURE AT DECEMBER 31, 2012

The shareholder structure of Volkswagen AG as of December 31, 2012 is shown in the chart above. Volkswagen AG’s subscribed capital amounted to €1,190,995,445.76 at the end of the reporting period.

The distribution of voting rights was as follows at the reporting date: Porsche Automobil Holding SE, Stuttgart, held 50.73% of the voting rights. The second-largest shareholder was the State of Lower Saxony, which held 20.0% of the voting rights. Qatar Holding LLC was the third-largest shareholder, with 17.0%; Porsche GmbH, Salzburg, held a 2.37% share of the voting rights. The remaining 9.9% of the 295,089,818 ordinary shares were attributable to other shareholders.

Notifications of changes in voting rights in accordance with the Wertpapierhandelsgesetz (WpHG – German Securities Trading Act) are published on our website at www.volkswagenag.com/ir.

MANDATORY CONVERTIBLE NOTE

In November 2012, Volkswagen successfully placed a mandatory convertible note in the amount of €2.5 billion, which entitles and obliges holders to subscribe for Volkswagen preferred shares. The note is backed by a subordinated guarantee from Volkswagen AG and was issued by Volkswagen International Finance N.V. The preemptive rights of existing shareholders were disapplied. By issuing the mandatory convertible note, Volkswagen has further strengthened its capital base in light of the outflow of funds for the acquisitions made in the second half of the year and the implementation of the strategic growth and investment program.

ANNUAL GENERAL MEETING

Volkswagen AG’s 52nd Annual General Meeting and the 11th Special Meeting of Preferred Shareholders were held at the Congress Center Hamburg on April 19, 2012. With 91.9% of the voting capital present, the ordinary shareholders formally approved the actions of the Board of Management and the Supervisory Board for fiscal year 2011, the creation of authorized capital and the corresponding amendment to the Articles of Association, as well as the authorization to acquire and use treasury shares.

The scheduled terms of office of Prof. Dr. Ferdinand K. Piëch and Dr. Michael Frenzel as members of the Supervisory Board expired at the end of the Annual General Meeting. The Annual General Meeting elected Ms. Ursula M. Piëch to the Supervisory Board for a full term of office as a shareholder representative. Prof. Dr. Ferdinand K. Piëch was reelected to the Supervisory Board, likewise for a full term of office. At the constituent meeting of the Supervisory Board, which was held after the Annual General Meeting, the members of the Supervisory Board reelected Prof. Dr. Ferdinand K. Piëch as Chairman of the Supervisory Board.

The Annual General Meeting also resolved to distribute a dividend of €3.00 per ordinary share and €3.06 per preferred share for fiscal year 2011.

At the Special Meeting of Preferred Shareholders, the preferred shareholders, with 36.5% of the voting capital present, approved the authorizing resolution on the creation of authorized capital and the corresponding amendment to the Articles of Association.

In connection with the Annual General Meeting on April 23, 2009, Verbraucherzentrale für Kapitalanleger e.V. (VzfK – German Protection Agency for Investors), Berlin, had filed an action for avoidance with regard to approval of the actions for fiscal year 2008. After this action had been dismissed in full by the Hanover Regional Court on May 24, 2011, the Celle Higher Regional Court backed this decision on January 25, 2012. This decision cannot now be appealed further. The Federal Court of Justice rejected the plaintiff’s appeal against denial of leave to appeal on October 9, 2012.

In connection with the Annual General Meeting on April 22, 2010, Verbraucherzentrale für Kapitalanleger e.V., Berlin, filed an action for disclosure and an action for avoidance with regard to approval of the actions for fiscal year 2009. Both actions were dismissed in full by the Hanover Regional Court on January 25, 2011. No appeal was permitted regarding the action for disclosure. The plaintiff filed an appeal for the action for avoidance. This appeal was also dismissed in full by the Celle Higher Regional Court on August 24, 2011. This decision cannot now be appealed further. The Federal Court of Justice rejected the plaintiff’s appeal against denial of leave to appeal on March 6, 2012.

The last legal disputes arising from past Annual General Meetings have thus been concluded with binding legal effect.